The digital transformation of commerce has dramatically shifted how income is earned, reported, and monitored. Electronic payment systems, online marketplaces, and gig economy platforms have become essential parts of financial life. To ensure income transparency in this evolving landscape, the Internal Revenue Service (IRS) introduced Form 1099-K. Understanding the role of this form, who it applies to, and how it affects income reporting is crucial for any individual or business involved in receiving digital payments.

Who Receives Form 1099-K?

A wide range of participants in today’s economy can receive Form 1099-K. Understanding who receives it helps individuals and businesses anticipate tax responsibilities and prepare accurate tax filings based on their earnings.

Independent Contractors and Gig Workers

Freelancers and gig workers earning through platforms like Uber, Lyft, or Upwork often meet the thresholds for receiving Form 1099-K. These platforms process payments through third-party networks, triggering reporting obligations. Gig economy participants must ensure they accurately track all income, even when earnings are spread across multiple platforms.

Online Retailers and Sellers

Individuals selling goods via Amazon, Etsy, eBay, or personal e-commerce sites who meet payment thresholds will likely receive Form 1099-K reflecting gross sales revenue. Sellers should note that the reported amount typically includes all transactions, even if some items were later returned or refunded.

Small Businesses Accepting Card Payments

Brick-and-mortar businesses, service providers, and mobile vendors accepting credit or debit card payments through processors like Square or PayPal are typically issued a 1099-K. These businesses must reconcile the amounts shown on the form with their internal sales records to correctly report net income after refunds and discounts.

Crowdfunding Recipients

Recipients of taxable crowdfunding proceeds may also receive Form 1099-K if payments are processed through platforms considered third-party networks, depending on the nature and use of funds raised. Crowdfunding participants need to distinguish between taxable business proceeds and personal gifts, as tax treatment varies significantly.

Reporting Thresholds for Form 1099-K

Thresholds for issuing Form 1099-K dictate when a payment processor must file this document with the IRS and provide a copy to the income recipient.

Historical Reporting Standards

Under the earlier standard, processors were required to issue Form 1099-K if a payee’s gross payments exceeded $20,000 and involved more than 200 transactions annually.

Lowered Thresholds from 2023

Significant changes to tax law reduced the federal threshold beginning in 2023. Now, a single transaction totaling $600 or more can trigger Form 1099-K reporting without a minimum transaction count.

This change substantially expands the number of individuals required to account for earnings, impacting casual sellers and part-time gig workers who were previously unaffected.

State-Specific Reporting Requirements

Several states, including Massachusetts and Vermont, implemented $600 thresholds before the federal update. Staying informed about both state and federal requirements ensures full compliance and prevents surprises at tax time.

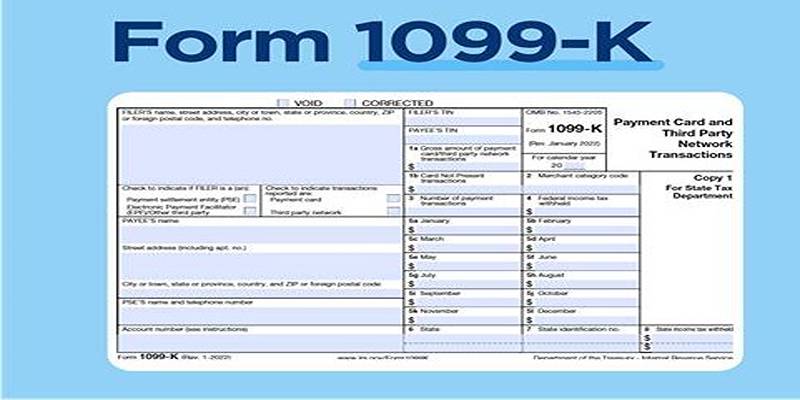

What Information is Reported on Form 1099-K?

Understanding the information presented on Form 1099-K is critical for reconciling income accurately when preparing tax returns. Each section of the form provides key data that both taxpayers and the IRS rely upon to ensure proper income reporting and compliance.

Gross Annual Payment Totals

The form lists the gross total amount of reportable transactions for the calendar year. It includes all payments processed, not just taxable income or net profits. Taxpayers must review this figure carefully, as it may also reflect refunds, returns, and other adjustments not considered part of taxable earnings.

Monthly Payment Breakdown

Monthly totals offer a detailed snapshot of transaction flow, assisting in reconciling internal bookkeeping with the processor’s reported amounts. By comparing monthly records against these figures, businesses can detect discrepancies early and correct any potential reporting errors before filing their tax returns.

Identification and Processor Information

The form displays the taxpayer’s identification information and the payment processor's details. This helps both the IRS and the taxpayer identify the source of the reported payments. Ensuring that personal or business information is accurate on the form is essential to prevent issues that might delay processing or trigger IRS inquiries.

How Form 1099-K Impacts Tax Filing?

Receiving a Form 1099-K has a direct effect on income tax obligations. Proper understanding and handling ensure tax returns are accurate and compliant.

Reporting Business and Personal Income

The income reported on Form 1099-K must be included in total income declarations. For businesses, it typically appears under Schedule C. Failure to report this income may trigger IRS notices.

Netting Out Business Expenses

Since Form 1099-K shows gross receipts, taxpayers must separately account for allowable business deductions like materials, shipping costs, advertising expenses, and transaction fees.

Avoiding IRS Mismatches

The IRS matches reported income against forms like the 1099-K. Any discrepancies between filed tax returns and third-party reports can lead to audits or penalties, making accurate reconciliation essential.

Managing Multiple Forms Received

Individuals working with multiple platforms or processors may receive several 1099-K forms. All forms must be combined and reflected in total gross income reported to avoid misreporting.

How to Prepare for Form 1099-K Compliance?

Preparation and attention to detail significantly ease the burden of handling Form 1099-K obligations.

Maintaining Detailed Transaction Records

Maintaining organized, thorough records of all sales, refunds, expenses, and personal transactions helps ensure accuracy when reconciling reported income.

Using Separate Accounts for Business Transactions

Maintaining separate financial accounts for business and personal activities simplifies reporting and minimizes confusion when tracking taxable income.

Reviewing Forms Upon Receipt

Upon receipt of Form 1099-K, careful review ensures that any inaccuracies are identified quickly, leaving enough time to correct mistakes before filing deadlines.

Seeking Professional Guidance

Tax professionals with expertise in handling electronic income reporting can provide critical assistance in maximizing deductions, ensuring compliance, and minimizing tax liabilities.

Conclusion

Form 1099-K is a key instrument for the IRS in tracking income generated through electronic transactions and third-party payment processors. Whether operating a small business, freelancing, or casually selling online, understanding how Form 1099-K works is critical for tax compliance.

Careful financial management, accurate recordkeeping, and proactive attention to changes in reporting standards position individuals and businesses to meet their obligations effectively.